One reason for the lack of infrastructure development in South America is corruption. In 2016, the region’s largest construction conglomerate, Grupo Odebrecht, paid USD 2.6 billion in fines over its involvement in a corruption scandal that spanned 10 countries, including Brazil, Argentina, Colombia, Ecuador, Peru and Venezuela. Besides the fact that the major infrastructure projects the company had planned never materialized, the scandal generated a perception of uncertainty on the part of international investors. The high levels of

corruption in South America became painfully obvious during the Covid-19 pandemic, which saw high-ranking officials and their cronies being secretly vaccinated ahead of healthcare workers in multiple countries. This was

also the case in Argentina, where the state has been accused of handing out direct contracts, without bidding, to a handful of companies that provided medical and personal protective equipment. In many South American countries, corruption has become so pervasive that it is widely accepted as an inconvenient part of everyday

life. This can negatively impact every aspect of a supply chain, from acquiring the permits to build a new manufacturing site, to a truck driver being arbitrarily arrested at a police checkpoint for failing to pay a bribe. Efforts to increase transparency by enacting anti-corruption legislation have generally been slow or ineffective. According to Transparency International, Guyana and Paraguay are the only countries in the region that have made real institutional improvements to address corruption in the last 10 years.

One of the main drivers of corruption in South America is organized crime and the large profits it generates. Although there are a vast number of illegal activities,

such as illegal mining, extortion, fraud and human trafficking, nothing generates as much money as drug trafficking, with the cocaine trade being the main

force behind corruption at the highest levels. The profits generated by cocaine have led to the rapid growth of illegal armed groups, from the former paramilitary group Gulf Clan (AGC) in Colombia, to the First Command of the Capital (PCC), Brazil’s largest criminal organization. Even the old communist guerilla groups, such as the National Liberation Army (ELN) in Colombia, or the Militarized Communist Party of Peru (MPCP), lost most of their ideological goals when they discovered the riches that could be obtained through the trafficking of cocaine, which has now become their main focus. Whilst the cultivation of coca is concentrated in Bolivia, Colombia and Peru, the processed drug travels to each country in the region. Even countries that are not located between the

producers and the large cocaine markets of the United States and Europe, are still heavily impacted. Take Argentina for example, where trucks driving from the

northern provinces of Jujuy and Misiones encounter checkpoint after checkpoint with police searching for drugs. Each time, this comes with the risk of cargo being compromised or even stolen. Any South American supply chain can therefore be affected by drug trafficking, which can lead to employees being extorted,

a company’s transportation network being hijacked, or accidental involvement in money laundering schemes. The impacts can range from shipments being mired in

red tape, to lasting reputational damage, to the safety of company staff being compromised.

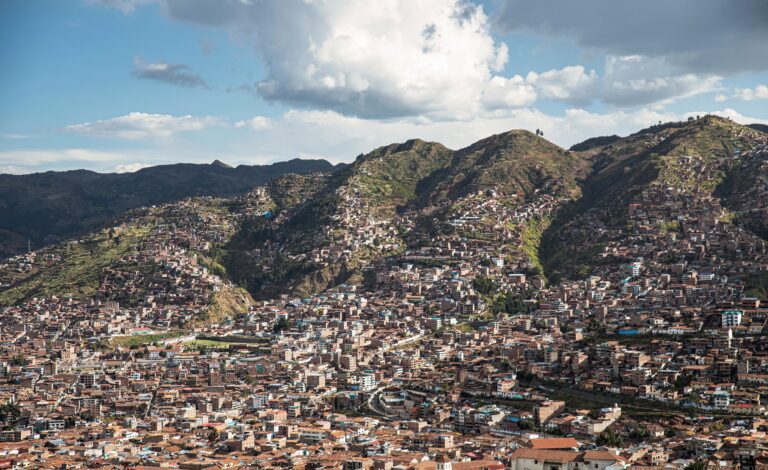

Insecurity in South America is being fueled by organized crime like no other region in the world. Whilst a lack of economic opportunities is causing high incident levels of petty crime in the cities, most of South America’s urban centers are actually a lot safer than they are commonly perceived to be. In the last 20

years, most of the region’s capitals have significantly reduced violent crime. In São Paulo, homicide rates have dropped by 90% due to the city’s police reform

and strict firearms controls, making it about as safe as Boston. In fact, most of South America’s major cities are significantly safer than cities in the United States.

Take Miami for example, which now has a significantly higher homicide rate than both Buenos Aires and Santiago, which is one of the reasons why these capitals

are attracting more and more foreign investments.

Of course, this does not mean that travelers should not have their guard up. Foreigners can easily become the target of a scam or robbery, especially when they display signs of wealth or lack situational awareness. Once outside of the

cities and even on the outskirts, the security landscape changes drastically for the worse. Criminal groups control vast areas that are too remote for security forces to reach effectively. Since so much of South America’s territory is geographically isolated, there are many areas where criminal groups can operate with near impunity. The key transportation routes and logistical hubs that connect these remote areas to the rest of the world are often contested by multiple criminal groups. Cities that have high-volume ports can become incredibly violent. Since 2020, the port of Buenaventura in Colombia has been the battleground of a turf war between ‘Los Shotas’ and ‘Los Espartanos’, although the two gangs have since declared a ceasefire. More recently, Ecuador’s capital Guayaquil has erupted with extreme violence as local gangs fight over the right to supply cartels in Mexico and the Albanian mafia in Europe on behalf of Colombian traffickers. Bodies now hang from Guayaquil’s lamp posts and bridges at a frequency that is reminiscent of

the most violent periods in the Mexican drug war. Meanwhile, record drug seizures are being reported in the port of Santos, near São Paulo, where the lack of a high homicide rate suggests the PCC remains firmly in control of the port it

uses to export cocaine to the Italian ‘Ndrangheta and elsewhere.

Besides drug trafficking, cargo theft has become one of the principal revenue streams of South American organized crime groups. Take the PCC for example, which has been involved in violent robberies on companies transporting

valuable goods in Paraguay, Bolivia and Brazil. In 2017, up to 60 heavily armed PCC gunmen robbed the transportation company Prosegur in Ciudad del Este, Paraguay. The suspects were able to escape after they exploded 16 vehicle

bombs across the city. In similar robberies, the group has used civilians as human shields by ordering them to stand in the middle of the street, or by tying them to the roofs of escape vehicles. What sets South American criminal

groups like the PCC apart from others is their capacity and willingness to use extreme violence, and their control over territory, which allows them to hide from authorities and stash their stolen goods.

Cargo theft requires knowing where and when goods are going to be, making it a criminal practice that heavily relies on insider participation. Unfortunately, extensive background checks do not always prevent this, since

insider involvement can be forced with a threat of violence. Either through “plata o plomo” (silver or lead), criminals frequently convince carrier, storage and customs personnel to share information about shipments or to participate in

heists. This allows criminal groups to identify high-value cargo, such as electronics, pharmaceuticals, or cash-in-transit. Other frequently stolen goods are less expensive but easier to sell on the black market, such as food, alcohol and

tobacco. The most common targets of cargo theft are trucks. In recent years, South America has had the highest rate of truck hijackings in the world, with Brazil topping the list of high-risk countries, which also includes Argentina, Chile,

Peru and Venezuela. Because South America’s shipping costs are usually higher than elsewhere in the world, having goods stolen is even more impactful.