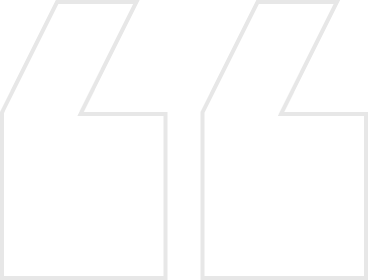

Reduce your insurance costs with Overhaul

Overhaul helps enterprises reduce claims and lower insurance costs by minimizing risk at the source with real-time visibility, proactive monitoring, and verifiable operational controls that insurers trust.

Reduce your insurance costs with Overhaul

Overhaul helps enterprises reduce claims and lower insurance costs by minimizing risk at the source with real-time visibility, proactive monitoring, and verifiable operational controls that insurers trust.

Insurance costs rise when shippers don’t have control

.svg)

.svg)

Overhaul enables lower premiums, stronger coverage terms, and fewer claim-driven surprises.

Give insurers confidence that risk is being actively managed, not passively observed.

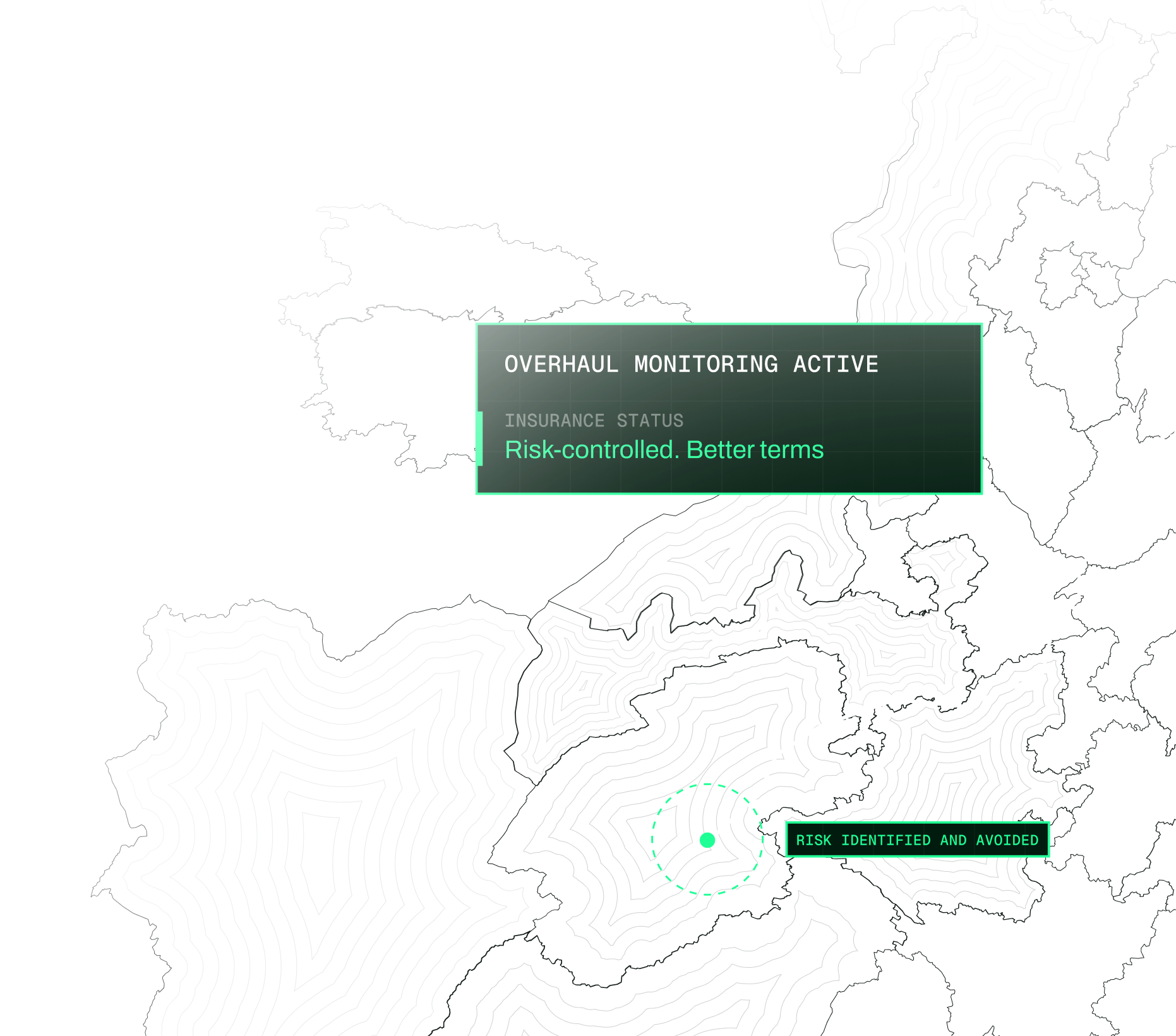

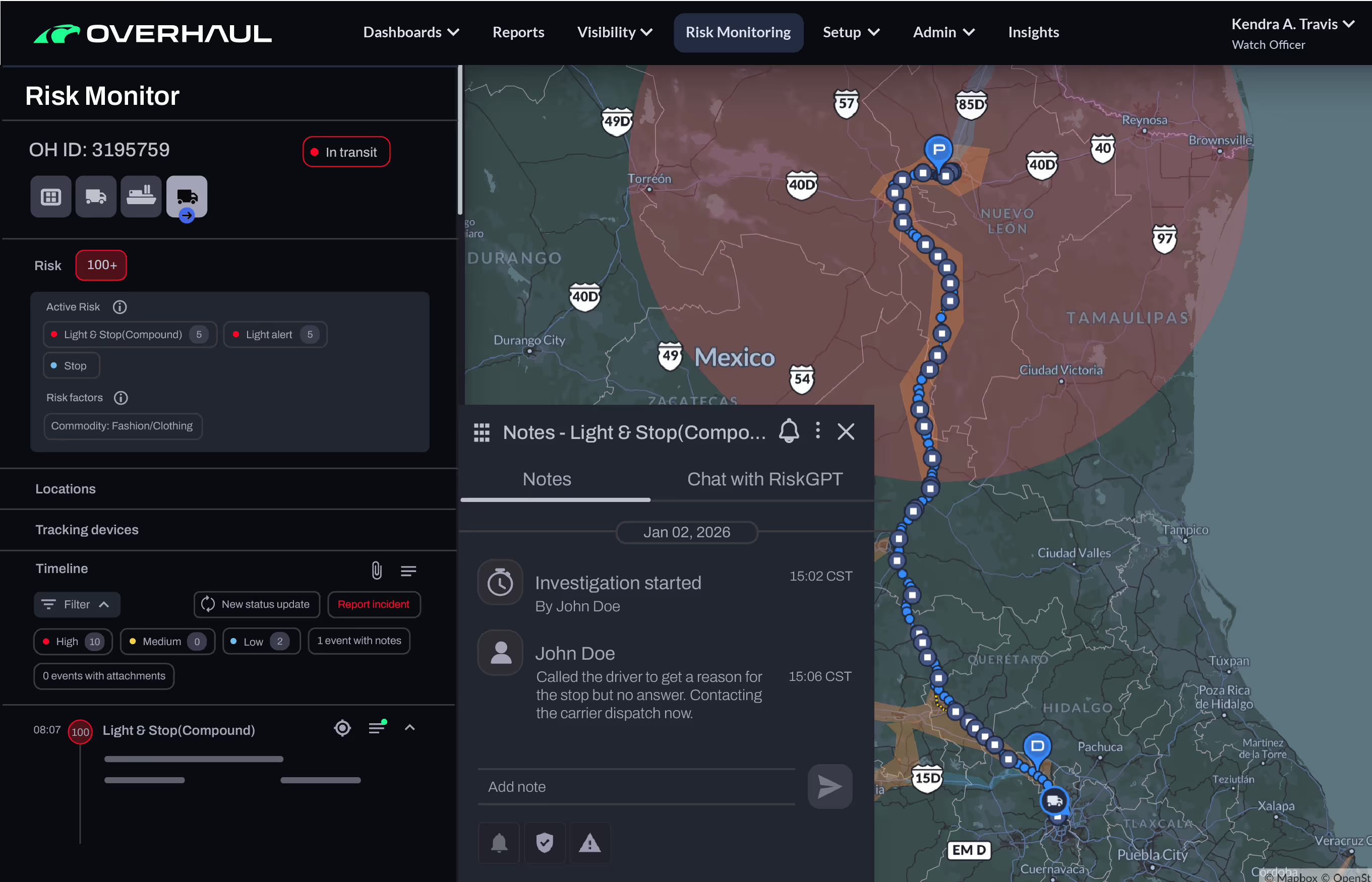

Proactive monitoring that prevents claims

Overhaul identifies high-risk behaviors and conditions as they happen. Whether managed by your team or Overhaul’s 24/7 GSOC, risks are detected early and addressed before they escalate into claims.

Documented controls insurers can trust

Create verifiable proof that risk thresholds are enforced, SOPs are followed, and incidents are actively managed so insurers gain confidence.

Reduce loss impact when incidents occur

Overhaul enables rapid response and coordinated recovery to limit loss value and shorten claim timelines, helping shippers improve loss performance over time.

Everything you need to lower insurance costs